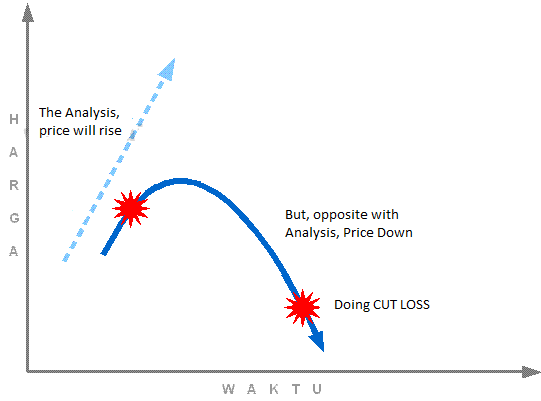

Cut loss means we are closing losing positions because prices move opposite to avoid greater losses.

SAMPLE CASE

Mr. X estimates that the price will rise from 1.2000 to 1.3000

So to get the profit he decided to buy at 1.2000 with the hope the prices will rise so he can close at the higher price and get more profit

But the price is down to 1.1700 and opposite of his analysis.

And after re-analysis, Mr. X concludes that it is likely prices will fall further, resulting in even greater losses.

So what should he do?

Rather than suffer a greater loss again, then Mr. X decide to close the position – well this is called cut loss

This action resulted in loss of 300 points.

Figure 1 Display Ilustasi CUT LOSS

Tips for you:

- Doing CUT LOSS if you after re-analysis, and the price will continue opposite your position

- If it turns out your decision in doing CUT LOSS is right, it means you have to prevent themselves from bigger losses

- If it turns out your decision in doing CUT LOSS is wrong, means you have to prevent themselves in terms of reducing the current loss (or even achieve profit). This means that prices will move in the direction of your initial expectations.

Are you a FAIL trader while doing CUT LOSS?

If you answered yes, you are WRONG. Please consider the following:

“Merrill Lynch & Co., the third- biggest U.S. securities firm, reported a wider-than-forecast quarterly loss as the credit contraction saddled the company with $9.7 billion of writedowns..” (Merrill Lynch & Co., perusahaan sekuritas ketiga terbesar di US melaporkan kerugian mereka lebih besar dari yang diprediksikan sebesar $9.7 milyar). Sumber: Bloomberg

Actually, what is the basis why until companies like Merrill Lynch & Co. also perform CUT LOSS even announced numbers in detail?

This is because there are still TRADING SESSION else. No matter Merrill Lynch & Co. suffered a loss of $ 9.7 billion dollars due to their side still look brighter tomorrow. Analysis of profit opportunities in the future they could be larger than the current losses. Still there are other times that you can achieve a much greater profit. Removing 1 wrong / false analysis is strongly recommended in order to trade better in the future.

Supposing you backwards one step in order to go forward 10 steps.