Summary

MACD indicator can be used for trading with the following signals:

- MACD lines are truncated – changing trends

- The MACD historical line is above zero – Market bullish (uptrend), if below – bearish (downtrend).

- The MACD Histogram line flips over zero – a confirmation of a force of a current trend.

- The MACD histogram line deviates from the price on the graphs of the upcoming reversal.

Details of MACD Indicator

MACD is a simple and very reliable indicator used by many trades. MACD (Moving Average Convergence / Divergence) based on Moving Averages indicator.

MACD indicator calculates and displays the difference between two moving averages at any time. As the market moves, the moving average moves with it, widening (divergence) as the market is trending and moving closer (convergence) as the market is slowing down and the possibility of changing trends emerging.

Basics of MACD indicator

The default indicator setting for MACD (12, 12, 9) is used in many trading systems, and this is the MACD arrangement developed by Gerald Appel and is best suited for both markets moving faster and slower. In order to get more responsive and faster performance from MACD, we can experiment with lower MACD settings, for example, MACD (6, 12, 5), MACD (7, 10, 5), MACD (5, 13, 8) , etc

This custom MACD setting will make the indicator signal faster, but the false signal rate will increase.

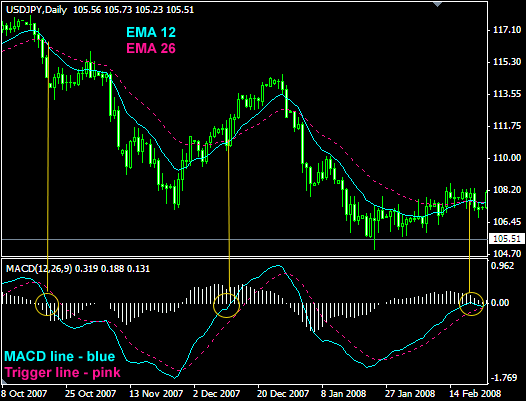

MACD indicator based on Moving Averages in the simplest form. MACD measures the difference between Moving Average periods faster and slower: EMA 12 and EMA 26 (standard).

The MACD line is created when the movingaverage period is subtracted from the shorter Moving Average. Consequently a momentum graph is created that oscillates up and down zero and has no lower or upper border. MACD also has a Trigger line. Combined in a simple crossover line strategy, MACD lines and Trigger crossover lines pass through EMAs.

MACD crossover is also capable of displaying where the EMAs chart has been cut: when MACD (12, 26, 9) flips above zero, it will show that EMA 12 and EMA 26 have been cut on the chart.

How MACD Indicator Work

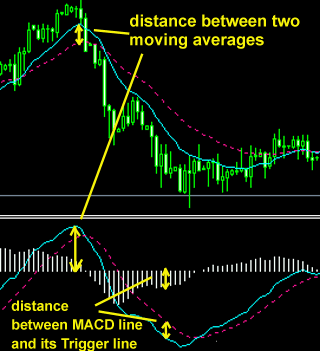

If we describe EMA 26 is a flat line, then the distance between the line and EMA 12 will represent the distance from the MACD indicator line to the zero line.

The MACD line goes further to the zero line, then the distance between EMA 12 and EMA 26 on the graph will be wider. MACD moves closer to the zero line, the closer the distance between EMA 12 and EMA 26.

The MACD histogram measures the distance between the MACD line and the MACD trigger line.

MACD Indicator Formula

MACD = EMA (Close) period1 – EMA (Close) period2

Signal Line = EMA (MACD) period3

Where:

period1 = default setting is 12 bar

period2 = standard 26 bar

perid3 = standard 9 bar

EMA = Exponential Moving Aberage

The following are the steps to calculate the MACD

1. Calculate 12-day EMA from closing price

2. Calculate the 26-day EMA from the closing price

3. MACD = 12-day EMA – (reduced) 26-day EMA

4. Line Signal = 9-day EMA from MACD

Formula for EMA

EMA = (SC X (CP – PE)) PE

SC = Smoothing Constant (Days count)

CP = Current Price (Current price)

PE = Previous EMA (EMA Previous)

Trading MACD Divergence

The MACD indicator is well-known for its Divergence MACD trading methods.

Differences are found by comparing price changes on charts and MACD values.

The Divergence MACD phenomenon occurs as a result of a shift in force in the forex market.

For example, while Seller may seem to dominate the current market and keep prices downtrend, there may already be a signal for overall weakening of selling power. This warning can be observed with the MACD indicator. Where a forex trader will see that despite making a new Lower Lows price, MACD does not confirm that this is a hihger low price register, and indicates that the Seller is running out of strength and the trend changes on the way. Then vice versa will apply to Buyer.

How to trade MACD Divergence

When the MACD signal (in our screenshot this is the blue line) passes the signal limit (red dotted lines) – we have a point (up or down) to evaluate.

Evaluate rows accepted, as shown in larger screenshots (click on image to enlarge).

With the appearance of MACD divergence we can enter the market when the MACD line crosses the zero point.

Another entry strategy is to look for the 2 most recent highs or low swings on the chart and draw a trend line, and then set the order Entry position (order) on the breakout of the trend line.