Heiken ashi candlesticks , some call it Heikin Ashi Candlesticks. Heiken-ashi candlesticks provides an interpretation of market trends in a neat and descriptive way. Candlesticks have been introduced to the Western world by Steve Nison. His book, “Japanese Candlestick Charting Techniques” presented a new approach to technical analysis. The Japanese approach.

History tells us candlestick charts appeared in the 18th century, in Japan. A rice trader used them to forecast prices.

By the time Nison presented them to the West, they were quickly embraced. It is no wonder, as the Japanese candlestick techniques are powerful patterns.

Mostly, Japanese candlestick patterns show reversal conditions. That is, after a bullish trend, the market forms a candle, or a group of candles, that show bears trying to take control.

Unlike regular Japanese charts (Candlesticks), heiken ashi candlestick does not show open, high, low and close. Instead they calculate the value of each candlestick based on the dominant power in the market. For example, if the bear (seller) dominates, heiken ashi candlesticks will be bearish (red), even if the price at the close bar is higher than open.

Heiken ashi candlesticks is the perfect tool for traders who like to follow the trend for those who are very extend. Heikin ashi also look much simpler.

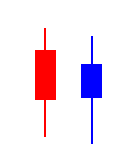

Heiken Ashi Candlesticks reading rule

Seller (Sellers) dominates, a strong downtrend

Buyers dominate, strong uptrend

Trend gets a little weaker, be careful

With the color change of a Heikin-ashi candlestick then the trend has changed

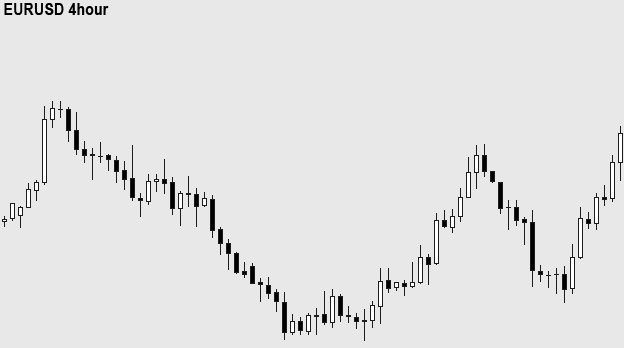

A regular Candlesticks chart (standard):

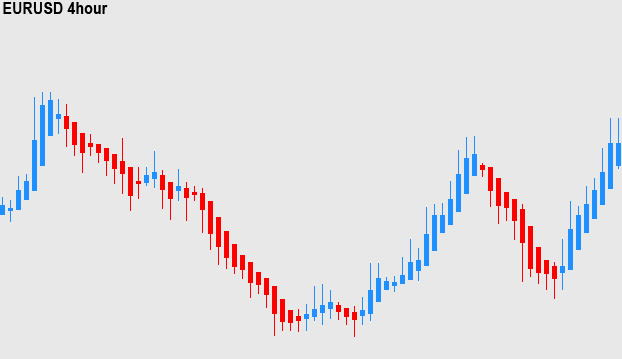

A chart with candlesticks heiken ashi indicator:

The trend on the Heiken ashi chart has seen more distinguished and more subtle.

But this does not limit the use of Heiken ashi candlestick in the forex market.

Heiken ashi candlesticks are good for trading signals and also for setting up trailing stops.

The trailing stop is placed at the bottom of the Heiken ashi bullish candlesticks on the uptrend condition and at the top of the bearish candlesticks in downtrend condition.

Heiken ashi Candlesticks is really amazing for trading signals!

Download Heiken Ashi Indicators

Heiken-Ashi.ex4_.zip